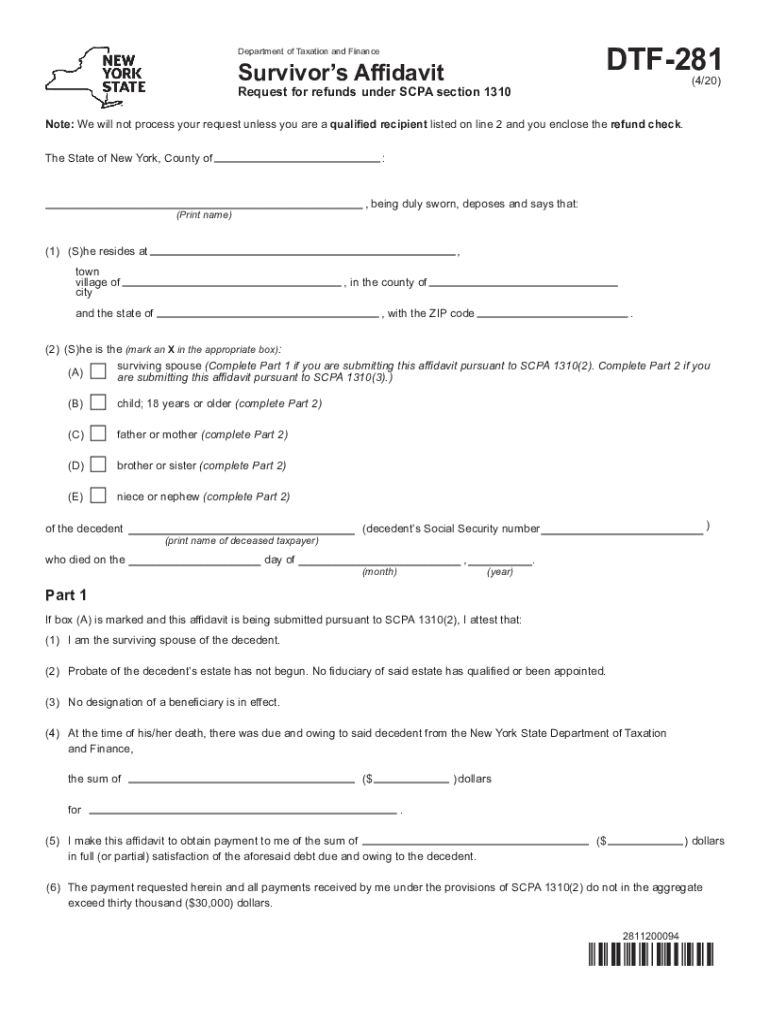

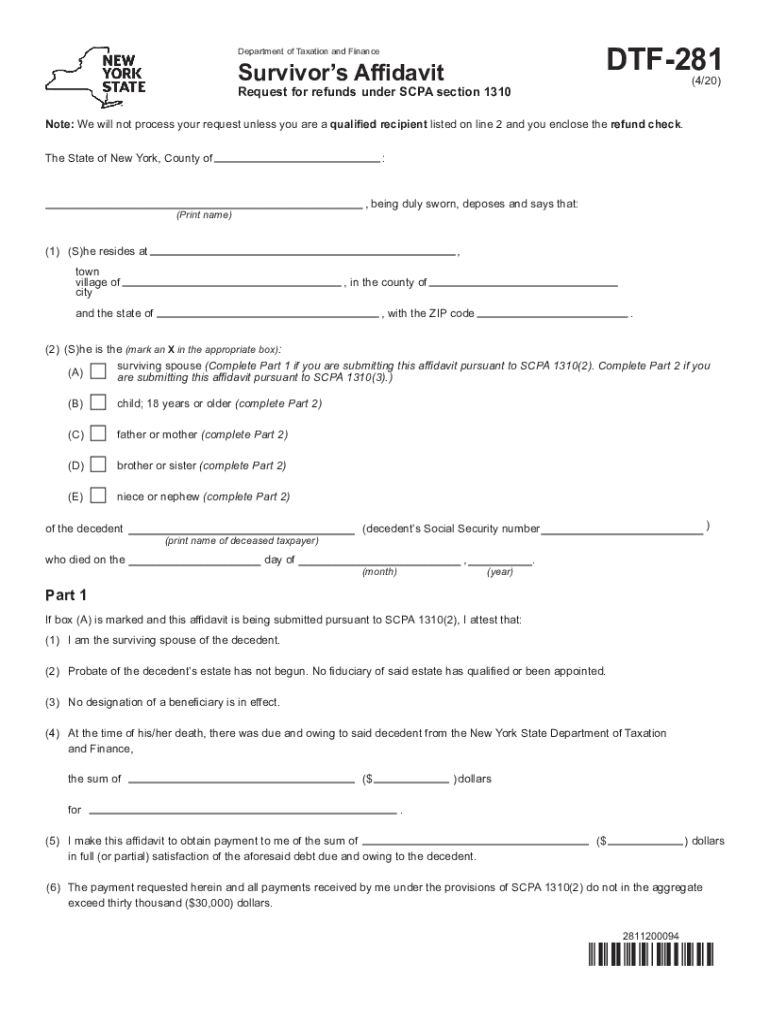

NY DTF-281 2020-2024 free printable template

Get, Create, Make and Sign

Editing dtf 281 online

NY DTF-281 Form Versions

How to fill out dtf 281 2020-2024 form

How to fill out tax return form?

Who needs tax return form?

Video instructions and help with filling out and completing dtf 281

Instructions and Help about payment york new form

Music embryo transfer and food animals began in the 1930s with sheep and goats and then began gaining popularity with beef and dairy producers in the 1970s and 80s as a way to take advantage of superior females and herds across the country simply put cattle embryo transfer is a drug-induced super ovulation of a cow or heifer the results in the production of multiple embryos an embryologist flushes and collects these embryos to transfer to other recipient females or freeze for future use after non-surgical methods were developed it has continued to increase in use across the United States and the world Music sonar females are selected based on a number of criteria including but not limited to pedigree genetic value phenotypic superiority and production records among other factors these females serve as a maternal base for beef and dairy herds across the country after the selection of a donor female an embryologist checks her for reproductive soundness before setting her up with a series of shots a schedule of shots is given over a four and a half day time period to synchronize and super ovulate the donor cow during the scheduled nine shots of follicle-stimulating hormone are given in declining dosages with shots of prostaglandin f2 alpha given on day four this series of shots causes the donor females ovary to grow and ovulate a larger than normal number of eggs the donor will then come into heat on day six at the first signs of standing heat the female is to be given a shot of Kennedy trope releasing hormone and bred twice at 12 and 24 hours following standing heat the eggs are then fertilized and the embryos begin developing in the donor cow exactly seven days after the female is in heat the embryos are then flushed out of the donor cow after the embryos are collected they are evaluated and graded on a one to four scale and given a development number on a one to nine scale embryos are classified according to these set subjective criteria grade one excellent or good grade two fair grade three poor and grade four dead or degenerating the development stages in the numbering system include stage one unfertilized stage two to twelve cell Stage three early more EULA stage for more ELA Stage five early blastocyst stage six blastocyst stage seven expanded blastocyst stage eight hatched blastocyst and stage nine expanding hatched blastocyst the embryos are then either implanted fresh into recipient females or frozen for later use or to be sold average flush is probably seven good improves the quality is and depending on animal every animal is wholly different no matter what greed or Holstein, but the beef generally have a little larger flushes a little more embryos conventional flushing is we actually get the donor call FSH or follicle stimulating hormone to get them to release more in one embryo and your breed to call and then a week later you flush the embryos and out of the cow there herself you can do the freeze every plan IVF what you do is you put...

Fill dtf 281 instructions : Try Risk Free

People Also Ask about dtf 281

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your dtf 281 2020-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.