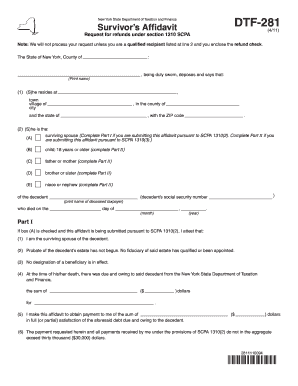

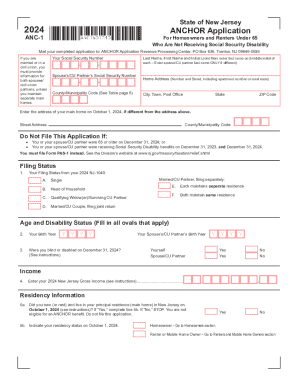

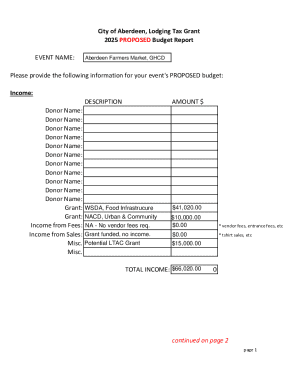

NY DTF-281 2020-2026 free printable template

Show details

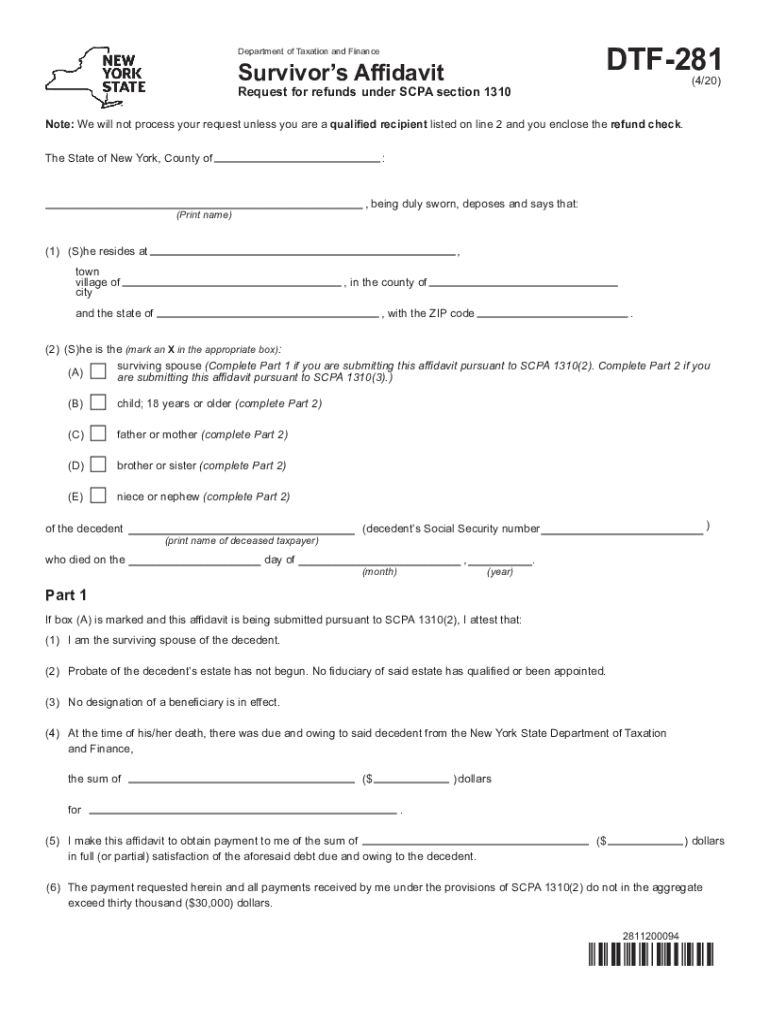

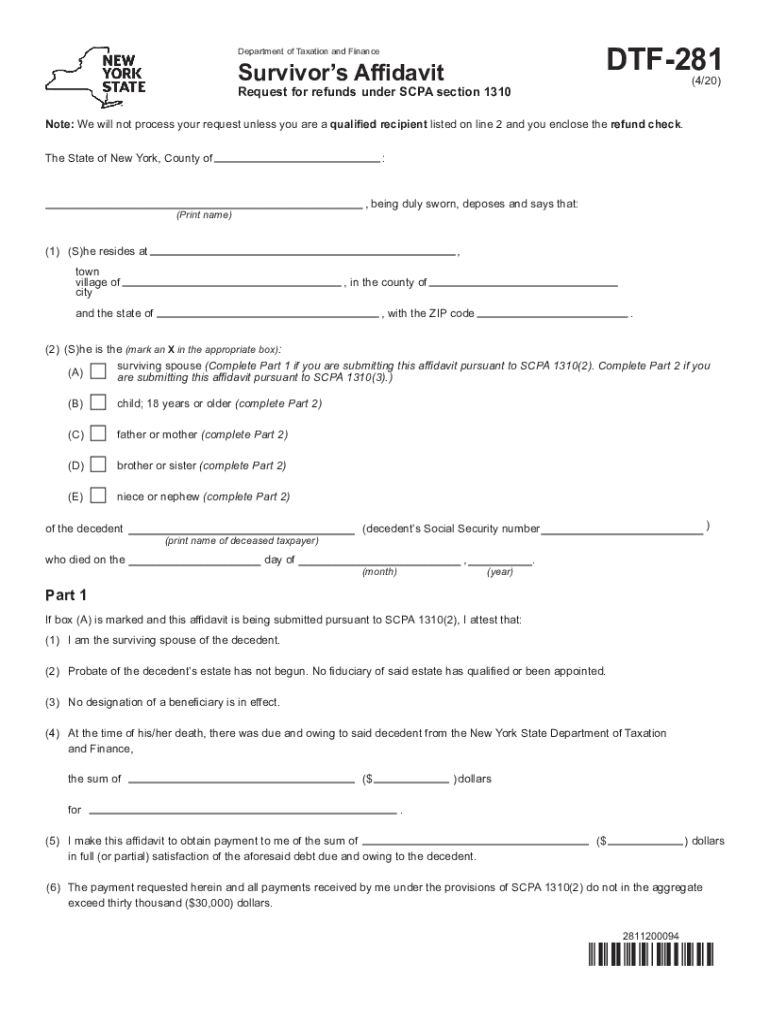

2811110094 DTF-281 4/11 back If box B C D or E is checked or if box A is checked and this affidavit is being made pursuant to SCPA section 1310 3 I attest that 1 I am the specify relationship to decedent 4 30 or more days have elapsed after the death of the decedent. DTF-281 New York State Department of Taxation and Finance Survivor s Affidavit 4/11 Request for refunds under section 1310 SCPA Note We will not process your request unless you are a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dtf 281 3 form

Edit your how to fill out ny dtf 281 necessary identification and payment details form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dtf 281 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dtf 281 form online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dtf 281 instructions form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF-281 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out employers and other entities that necessary identification and payment details form

How to fill out NY DTF-281

01

Obtain a copy of NY DTF-281 form from the NYS Department of Taxation and Finance website.

02

Write your name, address, and taxpayer identification number at the top of the form.

03

Indicate the year for which you are filing the form.

04

Provide details of the New York State tax credits you are claiming in the designated sections.

05

Include any necessary supporting documentation as required by the instructions.

06

Review the completed form for accuracy and ensure all sections are filled out.

07

Sign and date the form at the designated area.

08

Submit the completed form to the appropriate address listed in the instructions.

Who needs NY DTF-281?

01

Individuals or businesses claiming specific tax credits in New York State.

02

Taxpayers seeking to report tax paid on purchases made in New York.

03

Those who need to document eligibility for tax benefits or adjustments.

Fill

affidavit template new york

: Try Risk Free

People Also Ask about dhs form 281

Where do I get CRA tax forms?

order the package online at canada.ca/get-cra-forms. order a package by calling the CRA at 1-855-330-3305 (be ready to give your social insurance number)

What is a T4?

A T4 slip, or Statement of Remuneration Paid, is a document that summarizes all of the money paid by an employer to an employee during a calendar year. Most employers send your T4 electronically by February.

What is a T1 vs T4?

The T1 is a form filled out by employees and business owners, then submitted to the CRA. The T4 form, on the other hand, is filled out by employers and distributed to employees. The 2 forms provide similar information but have entirely different purposes.

How do I get my TD1 form?

Notice for employers give them the link to this webpage. Ask them to fill out the form and then scan it and send it to you online or give you a printed copy. create federal and provincial or territorial Forms TD1, following the instructions at Electronic Form TD1, and have your employees send them to you online.

What is the difference between T4 and T4?

A T4 slip shows the income you earned when you worked for an employer. A T4A, on the other hand, is a record of your earnings from being self-employed. TIP: While the T4 includes the Canada Pension Plan (CPP) and Employment Insurance (EI) deductions, the T4A doesn't.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in nys dtf bill?

The editing procedure is simple with pdfFiller. Open your nys dtf bill pyt in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the nys dtf bill pyt tax payment electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your nys dtf bill pyt tax and you'll be done in minutes.

Can I create an electronic signature for signing my nys dtf in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your new york state affidavit and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

What is NY DTF-281?

NY DTF-281 is a form used by taxpayers in New York to report and pay New York State's personal income tax withholding.

Who is required to file NY DTF-281?

Employers and other entities that withhold New York State personal income tax from wages or other payments to individuals are required to file NY DTF-281.

How to fill out NY DTF-281?

To fill out NY DTF-281, you need to provide information such as your employer identification number, the total amount of wages paid, the amount of tax withheld, and any other relevant details as specified on the form.

What is the purpose of NY DTF-281?

The purpose of NY DTF-281 is to facilitate the reporting and payment of withheld state personal income taxes to ensure compliance with New York tax laws.

What information must be reported on NY DTF-281?

Information that must be reported on NY DTF-281 includes the employer identification number, total wages paid, total New York State tax withheld, and any other necessary identification and payment details.

Fill out your NY DTF-281 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ny Affidavit is not the form you're looking for?Search for another form here.

Keywords relevant to nys dtf bill payment

Related to new york affidavit form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.